Forex trading is one of the most dynamic and complex forms of investing due to the constant fluctuation of the exchange rate. As such, mastering the psychological aspects of trading is critical for success. By understanding the psychological drivers behind trading decisions, traders can become well-equipped to enter the markets and enjoy long-term profitability. In this article, we will take a look at the basics of forex trading psychology for beginners, from the importance of controlling emotions to the implementation of risk management strategies.

Table of contents

The Role of Psychology in Forex Trading

Markets may be volatile, and forex trading is a dynamic and skilled business. As a result, traders are regularly forced to make hasty decisions under time constraints. However, the emotions that accompany this volatility can be a huge impediment to achievement. Fear, greed, and other emotions can cloud judgment and lead to impulsive decisions that can ruin a trader’s portfolio over time. To properly regulate their emotions during trading, traders must first understand the role of psychology in forex trading.

To help control their emotions, traders should become acquainted with basic psychology methods such as mindfulness, meditation, and journaling. These techniques can teach traders how to manage their emotions while also supporting them in becoming more aware of their thoughts and feelings. For example, mindfulness meditation can help traders maintain present-moment awareness while also reducing the detrimental impacts of stress on their trading activity.

Managing Your Emotions

A trader’s mentality has a huge impact on whether they are successful or unsuccessful in forex trading. Because the foreign currency market is volatile and unpredictable, traders are typically under pressure to move swiftly. Greed, fear, and overconfidence are just a few examples of emotions that can impair judgment and lead to impulsive behaviors that might affect a trader’s portfolio over time. As a result, the most important skill in forex trading psychology among beginners is learning to control your emotions.

To control their emotions, traders must learn to accept losses as a natural part of the game. Forex trading involves risks, and perfect forecasting of short-term trends and market movements is impossible. As a result, traders must retain their cool even in the face of losses and fight the need to succumb to strong emotions such as fear or greed. It is critical to remember that losses are an inherent part of trading and should not be used to justify leaving.

Another important aspect of controlling emotions is recognizing when emotions begin to take over. To ensure that their emotions do not influence their trading decisions, traders should be aware of their own psychological triggers and monitor their emotions on a regular basis. This can be achieved by maintaining a journal, reflecting on oneself, or seeking counsel from a mentor.

Controlling Losses

Trading currencies online is a highly speculative and risky practice. Because loss management is an intrinsic component of trading, traders must be prepared for it. Because it is difficult to predict the future direction of any currency or find a good deal every time, traders must develop strategies for reducing losses and retaining profits.

One of the most essential strategies for reducing losses is the use of stop-loss orders. These are orders that terminate a deal immediately when the value of the currency reaches a certain level. They can be configured as a percentage of the trading account or at a specific price level. Trading pros can reduce risks and protect profits by using stop-loss orders to limit potential losses to a certain threshold.

Another strategy for controlling losses is to limit the amount of money invested in any one currency. This is known as position sizing. Limiting the amount of money invested in any one trade can help traders reduce the impact of losses on their trading accounts.

Along with these strategies, traders can use automated tools such as risk management software to monitor trades, warn traders when a trade reaches a certain level, and even stop a trade automatically once it has lost a certain amount of money.

Develop a Trading Plan

The operations of a trader in the forex market are detailed in their trading plan. It serves as a decision-making roadmap and guarantees that trading is done gradually and scientifically. A well-designed trading strategy should include a number of critical components for success in the forex market.

Trading time is one of the most important aspects of any trading strategy. This requires determining the particular hour, or even day, of the week when the trader is most likely to benefit. A day trader, for example, may choose to focus on the busiest trading times of the day, whilst a swing trader may prefer to focus on longer-term patterns that form over many days.

The trade’s entrance and exit points are critical components of a trading strategy. This includes defining the exact levels at which a trader will enter or exit a trade, such as key support and resistance levels, or technical indicators, such as moving averages. By establishing defined entry and exit points, a trader can reduce the risk of making rushed decisions and stay focused on their trading objectives.

Another critical part of a trading strategy is the risk-to-reward ratio. This evaluates the likely risk and profit of a transaction. A good trading strategy should have a positive risk-to-reward ratio to guarantee that losses are kept to a minimum, and potential profits are maximized even if a deal does not go as planned. A standard technique is to aim for a risk-reward ratio of at least 1:2.

Related: Forex Scalping Strategies For Beginners & More

Risk Management Strategies

To increase their chances of success, traders must exercise effective risk management, which is an important aspect of forex trading. To help maintain their trading capital and achieve long-term profitability, traders must use a number of risk management techniques in addition to developing a trading strategy and controlling their emotions.

One of the most important risk management approaches is proper capital management, also known as money management. This strategy requires keeping track of both the total trading account and the amount of money involved in each trade. Effective capital management allows traders to maintain enough money on hand to trade while minimizing their losses. This can be accomplished by imposing trading constraints, such as limiting the total number of open trades at any given time or forbidding traders from risking more than 2% of their trading account on a single transaction.

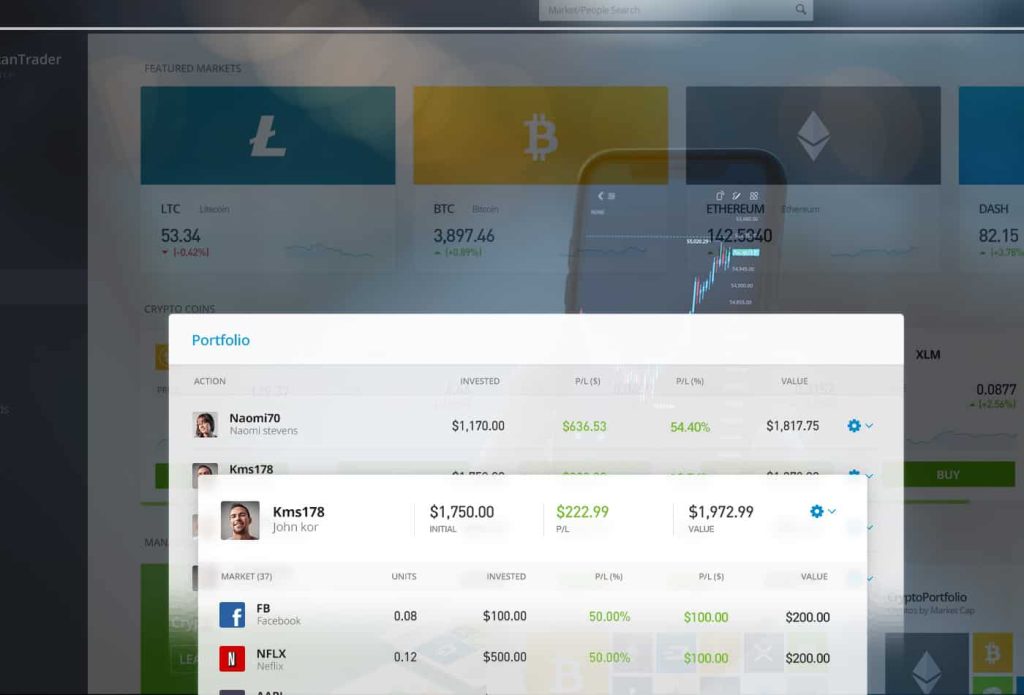

Portfolio diversification is an important risk management approach. Diversification helps to spread risk across multiple currencies or assets rather than focusing on a single currency pair or product. This can increase the possibility of long-term profitability while decreasing overall portfolio risk.

Furthermore, traders might consider employing stop-loss orders, which immediately terminate a transaction when the value of the currency reaches a certain threshold. This safeguards trading capital and reduces the likelihood of losses. Some traders also consider hedging, which is the process of buying and selling several currency pairs at the same time in order to reduce the overall risk of a portfolio.

Conclusion

Understanding the psychological elements that influence traders’ trading decisions is critical to trading success. Forex trading psychology is an important component of the trading process for beginners. Because the foreign exchange market is incredibly volatile and complex, understanding the psychological elements that affect the markets is critical for making well-informed trades.

One of the most important aspects of forex trading psychology among beginners is emotional management. Fear and greed are two emotions that can have a big impact on trading decisions and lead to impulsive trades that result in losses. Trading experts must learn to control their emotions and make sound decisions. This can be accomplished through the use of techniques such as mindful breathing exercises, writing, and setting precise, attainable goals. Trading professionals can increase their long-term success prospects by controlling their emotions.

Risk management is an important aspect of forex trading psychology. This means being aware of the risks associated with trading and devising measures to mitigate them. Risk management tactics include stop-loss orders, investment diversification, and just risking a small amount of the trading account on any given deal. Traders can reduce their chances of sustaining substantial losses while increasing their chances of long-term profitability by implementing risk management strategies.